Recent Blogs

Corporate Governance must be about people

32 years after the Cadbury Report defined modern corporate governance rules, corporate scandals continue to happen. Another version of the Corporate Governance Code came out in January with yet more minor changes. Why isn’t corporate governance working and why do...

Life is a risk

Risk simply means that we are not sure about what will happen in the future. If you know everything about the future, you haven’t got any risk. However, if you are mortal like the rest of us you are constantly wrestling with what might, or might not happen, in the...

Non-executive directors beware! They may be coming for you.

At the very last minute the Insolvency Service, acting for the UK Government, has just abandoned disqualification proceedings against five former non-executive directors of Carillion, which collapsed in 2018. This is a massive relief, not just to those individuals,...

Do men take revenge for diversity quotas?

A new academic study (1) is challenging one of the central policies of gender diversity -boardroom quotas for women. They have been the central plank of the push for diversity in business, not just to promote more diversity in the boardroom, but also to encourage it...

Politician, heal thyself

A company with just £24m annual revenue goes bankrupt with £1.9 bn of debts and a further £0.6m financing commitments. It made two appallingly large and risky investments that, not surprisingly, went disastrously wrong. It should have made national headlines amid...

Does good corporate governance lead to financial success?

Business is plagued these days with academic studies that come up with sensational conclusions, usually based on statistical regression. Many seek - and often get - wide media coverage if their claims are wild enough. To experienced business people, these reports...

FTX – the last word in corporate governance

In case any of us forget the importance of good corporate governance, have a look at the administrator John Jay III’s declaration* on the collapse of FTX, a company once valued at $32 billion. The governance was so bad, you might smile at some of this, but remember...

Can we all make better decisions?

Making better decisions is the holy grail of the boardroom. Corporate governance is full of rules and procedures, but very little on actual decision-making. There is however considerable academic discussion of good decision-making. A really interesting example of this...

Share buy-backs in trouble again

Lucy Tobin’s article in the Evening Standard drew my eye. Share buy-backs have always seemed to be controversial amongst commentators in the UK, and this article is yet another to criticise them. Let’s look at the arguments being used and see if they stand up to...

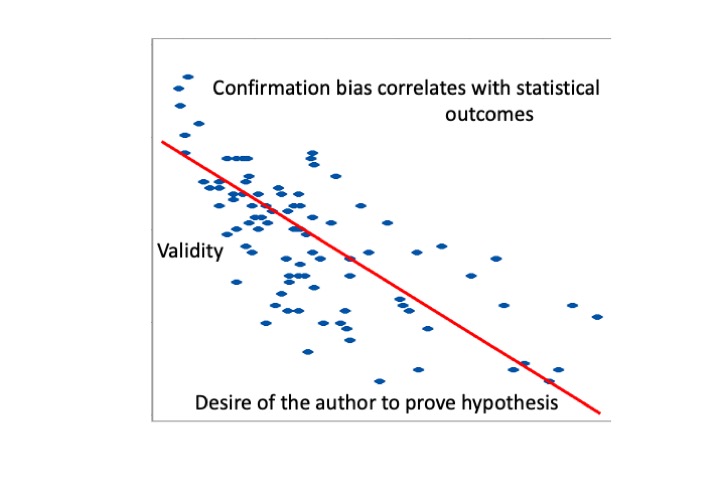

8 Tips to spot dodgy statistics

You’ve just seen a report that concludes what you ‘already knew’. Maybe it’s that having more diversity on a board increases profit, or that eating butter causes heart disease, or that first born children make better CEOs. You pass on, feeling suitably confirmed in...

Interview with PI World

https://www.piworld.co.uk/education-videos/piworld-interview-with-simon-laffin-secrets-of-the-boardroom-what-every-investor-should-know/

Boards need education not regulation

I joined the board of Northern Rock a month after it suffered its humiliating run featuring long queues of anxious savers. This was my first non-executive role, despite having been a FTSE 100 Finance Director for ten years. As I sat in the board, surrounded by...

Is Morrisons property portfolio really worth £9bn?

“Fears over Morrisons estate being sold on cheap…The shops, warehouses and factories owned by Wm Morrisons could be worth almost £9 billion – double the value the supermarket chain believes they are worth, raising concerns that a buyout firm could seize the assets on...

Corporate failures: Education,not more regulation

How do we improve corporate performance and avoid more corporate failures? The government is clear: We need more regulation. ‘Restoring trust in audit and corporate governance’ is the promise of the current white paper, whose consultation period ends on 8 July. It’s...

Sir Ken Morrison – his legacy and private equity

There is a lot of discussion at the moment about the legacy of Sir Ken Morrison and whether would have approved of a private equity bid for his company. I got to know Sir Ken during his protracted takeover of Safeway (where I was CFO), so it is worth revisiting his...

“A hotchpotch of pet ideas” – White Paper on audit & governance

Two successes from the pandemic have been the ‘Recovery’ treatment trials and new vaccines. Medical experts suggested possible options, tested each in blind trials, with the most successful treatments (such as dexamethasone) identified and rolled out globally, and...

Why we still get risk wrong

A ‘government source’ is quoted in the Times (25 May 2021), trying to defend the government against accusations that it failed to prepare adequately for the pandemic: “The reason we prepared for flu is because we have flu epidemics every year. The idea that you...

Sir Ken Olisa on inclusion, diversity, & competitive advantage

https://youtu.be/oNJetz62YMY

Interview with Sir Ken Olisa on corporate governance

https://www.youtube.com/watch?v=s9SPeJOdQnI

Is Tesco going green by being mean?

Tesco has proudly announced that it is the first UK retailer to offer sustainability-linked supply chain finance. That sounds great, well done Tesco! But wait a moment. What does this really mean? Supply chain finance is used when a company takes so long to pay its...

Scott Colvin on business lobbying, interview

https://youtu.be/yEAbWFW7N0A

Who pays for low interest rates?

So the Bank of England has cut interest rates again, to 0.25%, as ‘the outlook for growth in the short to medium term has weakened markedly’. It is also pumping £70bn new money into the financial sector, that is ‘monetary easing’ or ‘printing money’. Meanwhile,...

Are Old Boys’ Networks used as a recruitment weapon against women?

A fascinating piece of academic business research1 was posted on Linkedin. Not normally an aficionado of academic papers2, I couldn’t resist reading it. The title ‘Role of Old Boys’ Network and Regulatory Approaches in the Selection Process for Female Directors’ lured...

Tesco’s Barnard Castle moment of truth

Tesco, like Dominic Cummings, has a home in Durham, but not in Barnard Castle. Also, like the No10 guru, Tesco has come in for a lot of criticism about its application of the pandemic rules. It is banking £532m COVID-19 full year rates rebate, despite actually...

What’s behind the hedge?

If there’s one topic that is almost guaranteed to quieten a board meeting, it’s when the CFO starts proposing that the company takes out a hedge. This is a very complex area of financial management and almost no-one understands them, and even fewer want to admit it1....

Are you rearranging deckchairs on the Titanic? Taking corporate risk management seriously

I travelled from Tashkent to Moscow on an Aeroflot Ilyushin 86 in the early 1980s. The seats were basic metal framed deckchairs, screwed to the floor1. Why don’t airlines nowadays use simple deckchairs on airplanes, instead of very heavy, crash-resistant ones? The...

The Brydon Report – When looking backward should be the way forward

The much-awaited Brydon Report was published just before Christmas. It didn’t get much publicity, as the festive season proved more alluring than yet another long report and profusion of recommendations on corporate governance. In a sense, this was a pity as this...

Sexing up the statistics. Who needs facts?

“Want Higher Profits? Hire a Female CEO, CFO” The article headline caught my eye. Aren’t we all looking for a magic ingredient that can guarantee financial success? I think that women are disadvantaged and undervalued in business. And this doesn’t have to be the case....

Response to consultation on Market Study on Statutory Audit Services

I am responding to the request from the Government for views on the recommendations by the Competition and Markets Authority on the market for Statutory Audit Services. This submission is made in a purely personal capacity. Over the last 25 years, I have been chairman...

The Baked Bean Audit

What if the government insisted that every time you bought a tin of Heinz baked beans, you had to buy at least half a tin of Crosse & Blackwell ones too? You would have to explain to the grocery regulator why you chose Heinz, and if it thought that your choice was...

The audit punch-bag: Where is the voice of industry?

Storm clouds are gathering over the audit market. Government, politicians, media and regulators are all queueing up to condemn companies and auditors over the few, but well-publicised, failures of certain companies. Lack of knowledge about the audit process is no bar...

Motherhood & apple pie – the latest corporate governance regulations for private companies

The FRC has set out new proposals for more corporate governance regulation (the Wates Report) for large private companies. This is my response to the consultation. Summary High quality regulation should focus on outcomes and provide evidence to support new rules and...

How a bow-tie can smarten up corporate risks

Imagine that you are worried about your infirm mother and want to make sure that you do everything to protect her. If you adopted typical corporate risk management practice, you would identify a risk that she falls over. You would then calculate the impact (maybe a...

Carillion – What can we learn?

The collapse of Carillion was a tragedy, especially for its 45,000 employees and 25,000 pensioners. In an earlier article, I looked at its last Annual Report to see if there had been clues that could have tipped readers off to the impending catastrophe. Since then, we...

D. Using the annual report for your due diligence (the Carillion example)

Carillion has entered the pantheon of cursed companies following its recent failure. Politicians and the media have worked themselves in another fit of righteous indignation about greedy management and incompetent boards. The search is out for people to blame, shame...

Carillion – a salutary reminder on due diligence

Carillion has entered the pantheon of cursed companies following its recent failure. Politicians and the media have worked themselves in another fit of righteous indignation about greedy management and incompetent boards. The search is out for people to blame, shame...

Escape from the Rock

I gave a nervous laugh. The headhunter asked me if I would like my first non-executive director role, joining the board of Northern Rock. It was October 2007, a few weeks since the first run on a UK bank for 150 years. Struck by an uncharacteristic sense of adventure,...

What are dividends?

A simple question, I’m sure you’ll reply. Everyone knows that a dividend is money paid to shareholders by a company to reward them for owning its shares. However, a non-executive director needs to know a little more than this, as dividends can prove surprisingly...

To buy or not to buy, that is the question

Whether ‘tis nobler to buy back shares or pay a dividend? Introduction Maybe Hamlet was not so concerned with shareholder distribution, but most modern company directors certainly are. In an earlier article I reviewed why and how companies make shareholder...

“Marking our homework” – Why executives resent non-execs

It won’t be long into your first non-executive job when you start to feel as if the executives resent you. It’s okay. You haven’t become paranoid. They really do resent you. Why? Being an executive director is a tough job. You work all the hours that the Working Time...