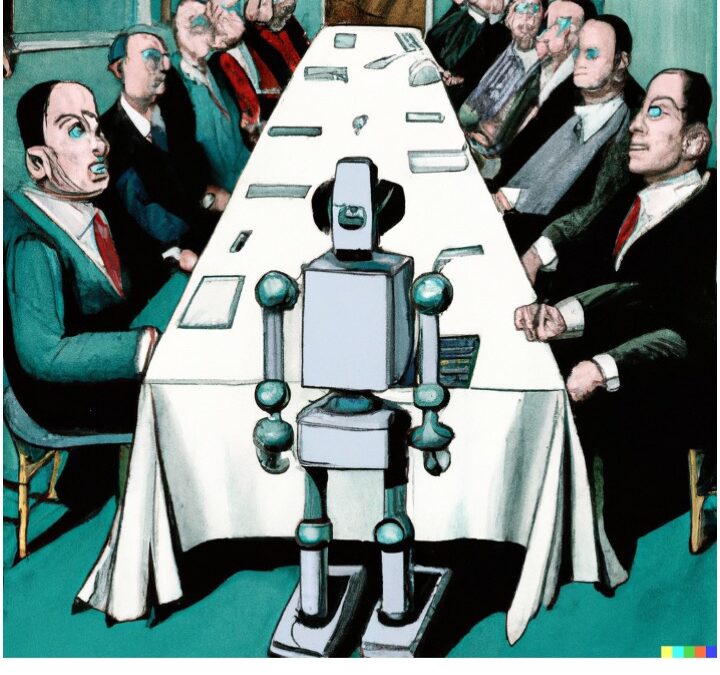

32 years after the Cadbury Report defined modern corporate governance rules, corporate scandals continue to happen. Another version of the Corporate Governance Code came out in January with yet more minor changes. Why isn’t corporate governance working and why do corporate failures keep happening? Growing frustration is leading to demands for ever more regulation, but we’ve actually already got the benefits from good governance. Added pressure...